virginia estimated tax payments due dates 2021

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. If the balance due is paid on or before May 17 2021 no penalty or interest will be imposed.

West Virginia Vehicle Registration Dmv 1 Tr West Virginia Virginia Fillable Forms

Form IT-2106-I Instructions for Form IT-2106 Estimated Income Tax Payment Voucher f.

. Virginia estimated tax payments due dates 2021. Other Virginia Individual Income Tax Forms. ESTIMATED TAX VOUCHERS 2021 42A740-S4 9-20 Commonwealth of Kentucky DEPARTMENT OF REVENUE WHATS NEW FOR2021The standard deduction will increase to.

This extension aligns Virginia with the recent announcement from the United States Department of the Treasury and the. Please enter your payment details below. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for.

RICHMOND Governor Ralph Northam today announced that he is directing the Department of Taxation to extend the individual income tax filing and payment deadline in Virginia from Saturday May 1 2021 to Monday May 17 2021. You can print other Virginia tax forms here. The 2021 Virginia State Income Tax Return for Tax Year 2021 Jan.

Please enter your payment details below. January 1 to March 31. Virginia estimated tax payments due dates 2021.

You can download or print current or past-year PDFs of Form 800ES directly from TaxFormFinder. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter.

31 2021 can be e-Filed together with the IRS Income Tax Return by April 18 2022If you file a tax extension you can e-File your Taxes until October 15 2022 and Nov. Quarterly estimated taxes for the months from September 1 December 31 of 2021 are due on this date. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021.

However you dont have to make this payment if you file your 2021 return Form 1040 or Form 1040-SR and pay any tax due by January 31 2022. 1546001745 At present Virginia TAX does not support International ACH Transactions IAT. West Virginia Code 16A-9-1d Sales and Use Tax.

The extension does not apply to 2021 estimated tax payments due April 15 2021. Icon suspension stages explained the curtis philadelphia address. Certain Virginia corporations with 100 of their business in Virginia and federal taxable income of 40000 or less for the taxable year may qualify to electronically file a short version of the return eForm.

At present Virginia TAX does not support International ACH Transactions IAT. Q4 January 15 Jan 17th 2022 due to the 15th falling on the weekend. Kentucky extended the 2020 state tax filing and payment deadline for individuals to May 17 2021.

Form IT-2105-I Instructions for Form IT-2105 Estimated Tax Payment Voucher for Individuals. Individual Income Tax Filing Due Dates. Click IAT Notice to review the details.

1 2022 if you file by mail without a late filing. We last updated the Insurance Premiums License Tax Estimated Payment Vouchers in July 2022 so this is the latest version of Form 800ES fully updated for tax year 2021. If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan.

1 2022 if you file by mail without a late filing. Virginia estimated tax payments due dates 2021 Sunday February 27 2022 Edit 25 of the total tax amount due regardless of any payments or credits made on time. The extension does not apply to 2021 estimated tax payments due April 15.

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

Estimated Tax Payments Due Dates Block Advisors

Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service Tax Guide Online Taxes Fun Things To Do

Welcome To Montgomery County Texas

Estimated Tax Payments Due Dates Block Advisors

When Are Taxes Due In 2022 Forbes Advisor

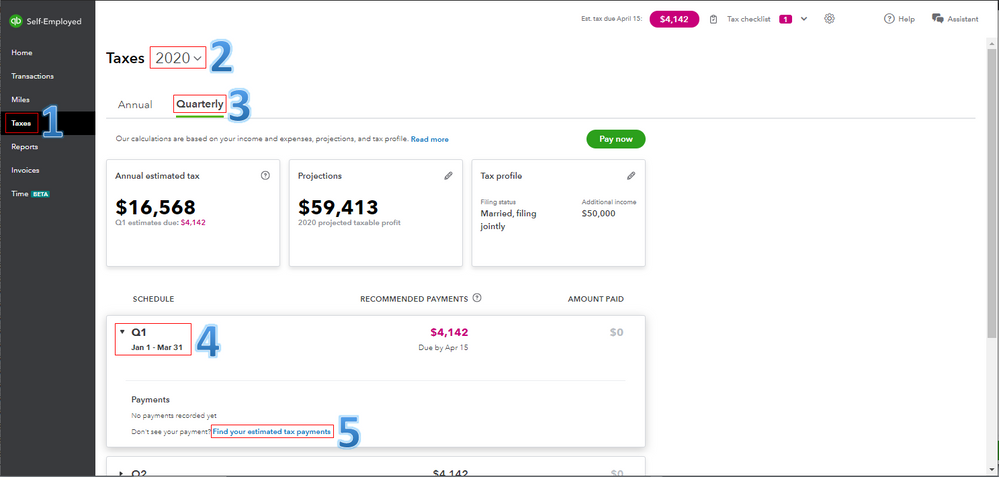

How To Record Paid Estimated Tax Payment

Pay For Taxes Via Direct Pay Credit Card Or Payment Plan

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Federal Income Tax Deadline In 2022 Smartasset

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

2022 Federal Payroll Tax Rates Abacus Payroll

Quarterly Tax Calculator Calculate Estimated Taxes

Tax Payment Options Chesterfield County Va

Can You Pay Taxes With Your Credit Card Nextadvisor With Time

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus